Introduction

Professional financial planners assist you in arranging and planning your financial resources. How much money you can expect to have in retirement is calculated using your current income, savings, and assets. To that end, they offer advice on how best to allocate your resources. "financial planner" and "financial advisor" refer to the same type of expert in personal finance. Although there are a variety of paths to becoming a planner, not all advisers and planners share the same characteristics.

The quality of advice you receive heavily depends on the planner's education, training, and expertise. A planner can help you make better plans if you already care for your finances. Understanding what to anticipate from a financial planner will help you make an informed decision about seeking assistance. Find out if the individual you're talking to is trying to sell you something or if they have the credentials to give you sound financial advice.

How a Financial Planner Can Help You Meet Your Goals

There are many planners, and many offer tax and estate planning services. Inquire if the planner addresses the concerns above and if they provide written recommendations. It is always preferable to have advice provided in written form. That way, there won't be any confusion about what to do next. Planners trying to sell you something right away instead of helping you plan isn't favouring you. Without first learning about your objectives and conducting a long forecast, a competent planner should not advise you on your requirements. Financial planners should ask to see all relevant account statements and documentation.

A Financial Advisor Can Help You

If you want to secure your financial future, consulting with a financial counsellor can be helpful. They will be there for you through the ups and downs of life, offering tailored guidance to help you identify and achieve your goals. A financial advisor is a great resource if you have questions or want to learn more about financial concepts and best practices.

Put Together a Financial Plan

Your advisor can help you make a detailed plan that lays out the steps you need to take to save for retirement, fund a child's education, buy a home, car, or cottage, or pay for a wedding. As your goals, priorities, and circumstances shift, they will help you reevaluate your investments.

Choose Investments That Align with Your Goals

A financial advisor can assist you in sorting through the various financial products on the market and selecting the best ones for your specific needs. They may also aid you in concentrating on paying down debt and putting money away for the future.

Learn About Investing Concepts and Best Practices

Learn about investing and get advice from a pro by working with a financial advisor. A financial advisor can show how recent market events affect your portfolio. They'll be able to address your concerns and guarantee your comprehension of the whole procedure.

Maintain Self-Control, Keep Tabs on Your Investments, and Adjust as Required

A financial advisor's job is to keep a close eye on how you're doing financially and how close you are to achieving. Let's say the market dramatically improves, or a subset of it drastically declines. Your advisor will know what happened, the outlook, if and how your portfolio needs to be repositioned, and how to make those changes. Furthermore, if your portfolio maintains its current course, it can serve as a source of self-discipline in the face of market volatility.

Know When Other Experts Are Needed

Your financial advisor can serve as your primary point of contact and a referral source for other professionals as needed. Not only can they help you determine if and when you need the services of a tax advisor or accountant, but they can also steer you through the maze of estate duties.

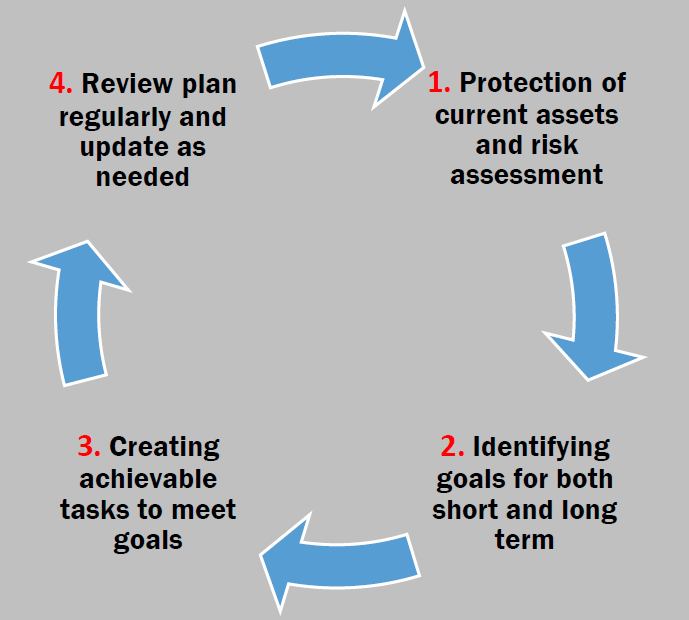

What Is Financial Planning?

To achieve those goals, you should engage in financial planning. One way to do this is to plan out your financial obligations. You decide on a destination and a path to get there, complete with checkpoints. The next step is to map out the steps you'll need to take to reach your milestones and accomplish your objectives.

Conclusion

In addition to traditional financial planning services, some advisors assist with managing investments and providing investment advice. You can get investment advice on a wide range of topics, from what asset allocation model you should use to which investments you should buy and sell. It's important to clarify with your planner whether or not they also provide investment advice or just planning services. Some individual investors believe they can get by just using the internet, Robo-advisors, or big national financial advisory firms.

You can improve the level of individualised service you receive by collaborating with a Financial Dynamics & Associates advisor. If you are considering retiring somewhere else, our advisors can provide you with information about the decisions that other individuals and families in our community have made so that you can make an informed decision. To gain insight into your tax situation and other financial matters, a local financial planner may be of assistance.